As we step into the new year, investors are looking for stable and lucrative investment opportunities. Real Estate Investment Trusts (REITs) have emerged as a popular choice, offering a unique blend of income generation and diversification. Exchange-Traded Funds (ETFs) provide an efficient way to invest in REITs, allowing individuals to gain exposure to a broad portfolio of properties with minimal effort. In this article, we will explore the

5 best REIT ETFs to buy for 2025, as highlighted in the April edition of Forbes.

What are REIT ETFs?

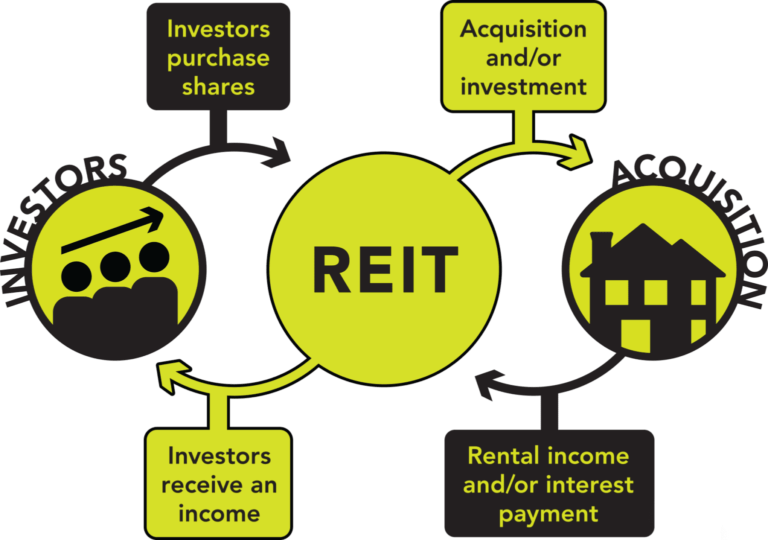

REIT ETFs are a type of investment fund that tracks a specific index or sector of the real estate market. They allow individuals to invest in a diversified portfolio of properties, such as office buildings, apartments, and shopping centers, without directly owning physical assets. REIT ETFs offer a range of benefits, including:

Diversification: By investing in a broad portfolio of properties, REIT ETFs reduce the risk associated with individual assets.

Income generation: REITs are required to distribute at least 90% of their taxable income to shareholders, providing a regular stream of income.

Liquidity: REIT ETFs can be easily bought and sold on major stock exchanges, providing flexibility and convenience.

Top 5 REIT ETFs to Buy for 2025

Based on the April edition of Forbes, the following are the top 5 REIT ETFs to consider for 2025:

1.

Vanguard Real Estate ETF (VGSIX): With over $70 billion in assets under management, this ETF is one of the largest and most popular REIT funds. It tracks the CRSP US Real Estate Index and offers a low expense ratio of 0.12%.

2.

Schwab U.S. REIT ETF (SCHH): This ETF tracks the Dow Jones U.S. Select REIT Index and offers a low expense ratio of 0.07%. It has over $5 billion in assets under management and provides a diversified portfolio of REITs.

3.

iShares Core U.S. REIT ETF (IT): With over $10 billion in assets under management, this ETF tracks the CRSP US Total Market Real Estate Index and offers a low expense ratio of 0.08%.

4.

Real Estate Select Sector SPDR Fund (XLRE): This ETF tracks the Real Estate Select Sector Index and offers a low expense ratio of 0.13%. It has over $4 billion in assets under management and provides a concentrated portfolio of REITs.

5.

Invesco S&P 500 Equal Weight Real Estate ETF (EWRE): This ETF tracks the S&P 500 Equal Weight Real Estate Index and offers a low expense ratio of 0.40%. It has over $1 billion in assets under management and provides a unique approach to REIT investing by equally weighting each stock.

Investing in REIT ETFs can provide a stable source of income and diversification for your portfolio. The top 5 REIT ETFs highlighted in this article offer a range of benefits, including low expense ratios, diversified portfolios, and a strong track record of performance. As we move into 2025, these ETFs are well-positioned to take advantage of the growing demand for real estate investments. Whether you're a seasoned investor or just starting out, REIT ETFs are definitely worth considering as part of your investment strategy.

Remember to always do your own research and consult with a financial advisor before making any investment decisions. With the right approach and a solid understanding of the market, you can make informed decisions and achieve your long-term investment goals.